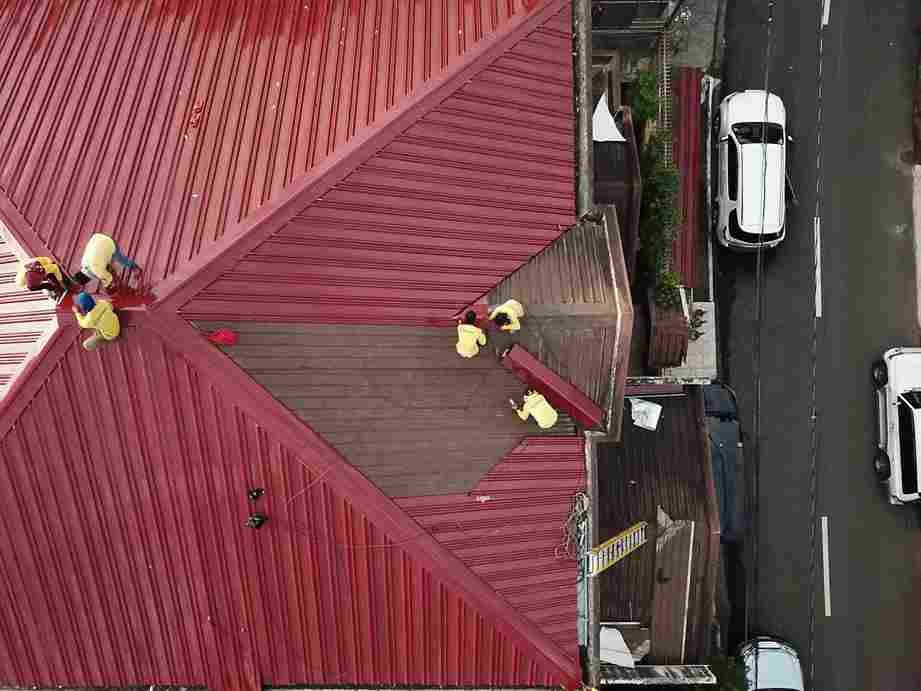

Can You Get A Mortgage On A House With An Asbestos Roof

We Buy Houses With Asbestos Roof

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

If you're looking to purchase a home with an asbestos roof, you might be wondering if you can still get a mortgage. The short answer is yes – as long as you can show that the roof is in good condition and is properly maintained, there are a few mortgage providers or mortgage brokers lending money for homes in this condition.

In fact, many mortgage lenders are happy to approve a mortgage and provide mortgage advice for a property with an asbestos roof or asbestos present so long as you can provide documentation proving that the roof is safe and in good condition and does not pose an immediate health risk.

What is Asbestos?

Asbestos is a naturally-occurring mineral that has been used in many products throughout history. It was once popular for use in roofs and asbestos siding during renovation projects, as it was a great insulator and common building materials. However, asbestos is dangerous, especially when it comes into contact with the human body, causing lung cancer and other illnesses.

This makes obtaining an asbestos mortgage that much harder than a normal mortgage loan without a proper risk assessment, an asbestos survey, and tailored advice from local authority and real estate agents.

Should You Repair or Replace an Asbestos Roof?

Should you repair or replace an asbestos roof? This one depends on a number of factors, including the market value of the home if there is loose fill insulation, what the risk level is if asbestos removal is safe if asbestos fibers are present, how much asbestos is present, and what the lender criteria are.

Will a Mortgage Broker or Mortgage Provider Require You to Fix the Roof?

If the roof is in good condition and the asbestos is properly sealed and not accessible, it may not be necessary to replace the roof. In some cases, repairs may be sufficient.

However, if the roof is not in good condition or the asbestos is accessible, replacement is likely the best course of action. Of course, you should follow the guidance of professional advice on whether or not to remove asbestos. Speaking with a specialist contractor who works with asbestos properties to conduct the initial investigation is a smart move.

How to Get a Mortgage on a House with an Asbestos Roof

Working with either an online mortgage advisor or local mortgage brokers at a metro bank or local credit union is essential to securing a mortgage on a home with asbestos in any form.

As standard with all loans, a lender will have you fill out a mortgage application, check your credit score by running a credit report, review the property value, ask for your approximate annual income, and then either offer you a mortgage approval or a mortgage declined letter.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Different Types of Bank Finance

Your mortgage broker will offer mortgage advice and guide you in the right direction to secure a mortgage deal. Often the best mortgages included rehabilitation mortgages and government backed loans offered by the FHA versus a conventional loan.

Many mortgage providers lending in your area will offer mortgages such as conventional loans and types of FHA loan options to fit your needs. Speaking with a mortgage introducer or real estate agent will get your going in the right direction as you secure a loan on a home with existing asbestos. If you can get a mortgage online, that is also a great option if you're looking for companies that will accept properties with asbestos present.

We Buy Houses With Asbestos Roof

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

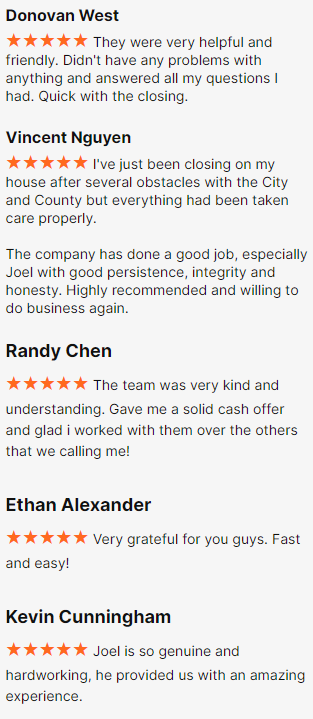

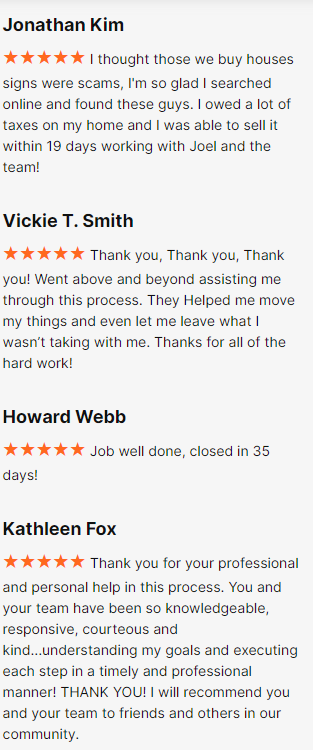

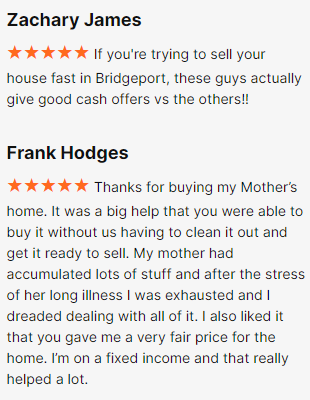

Happy Customers

All Rights Reserved | Fire Cash Buyers