House Fire Insurance Claim Denied: Here's Why

House fires are one of the most devastating things that can happen to a family. In addition to the emotional trauma, the significant financial loss comes with rebuilding your home. Many people think that their homeowner's insurance will cover these costs, but unfortunately, this is not always true after a property loss.

Upfront, we want to tell you that selling your fire damaged house after a fire is an option we're extending to you if you need the cash and are ready to move on with life. Our goal is to provide you with essential tips for successfully selling a fire damaged house and maximize the value of your fire damaged house during selling, ensuring you get the best possible outcome from the sale.

3 Tips To Increase The Likelihood Your Fire Insurance Claim Doesn't Get Denied

Make sure your home is properly insured:

The first step in making sure your fire insurance claim is not denied is to ensure that your home is properly insured to avoid claim denials. Most homeowner's policies cover fire damage, but the amount of coverage you have may vary depending on the company policy you have. Therefore, it is essential to review your fire insurance policy and have enough coverage to rebuild your home if it burns down as a responsible homeowner.

Follow the safety guidelines laid out by your insurance company:

To avoid having your fire insurance claim denied by a claims manager, it is essential to follow the safety guidelines laid out by your insurance provider and the state's department of safety regulations and building codes. These guidelines may vary depending on the company and where you live.

Typically they include things like having a working smoke alarm, having a fire extinguisher, installing fire alarms, and keeping flammable materials away from heat sources. If you do not follow these guidelines and your home catches fire, you might encounter a home insurance claim denial from your insurance carrier or insurance adjusters.

Report any fires immediately:

If you experience a house fire, it is essential to report it immediately to your insurance office. It will allow your insurance provider to begin its investigation into the cause of the fire, gather evidence and witness statements, and determine if you are eligible for coverage. Additionally, it is essential to keep all receipts and documents related to the fire you may need when you file a claim, including repair estimates, consultation fee receipts, and anything else an insurance company can bring up in a dispute.

Why Property Insurance Claims Are Denied?

There are many reasons why insurance companies deny fire claims.

Here are some of the common reasons why an insurer denied a home fire insurance claim.

The homeowner has not kept up with their insurance premiums:

If the homeowner has failed to keep up with their premium payments, the insurance company can deny coverage for any property damage claims. If you miss one payment, it will cancel your coverage immediately and harm your ability to file an appeal or claim. If you don't pay within 30 days after being notified by the insurance provider, it will terminate your ultimate insurance coverage.

You should also know that sometimes homeowners forget to renew their policies before they expire or choose not to continue them, believing that they won't suffer any losses in the coming year. However, they fail to realize that when they don't renew their policies. As a result, they stand a much higher risk of having their claims denied since they don't have coverage.

The loss is excluded from coverage:

Many policies have exclusions for certain types of losses, such as damage caused by vermin or acts of war. It can also include maintenance-related issues, such as a pipe bursting due to freezing temperatures in winter which can cause further damage down the road. The best way to avoid this type of denial is to understand your fire insurance coverage and make sure that you keep up with regular maintenance tasks around your home.

The homeowner's deductible is higher than the amount of loss they're claiming:

It is common for insurance companies to deny a homeowner's claim if the amount of damage is less than the homeowner's deductible. For example, if a homeowner has a $500 deductible, but their damages only total $400, the insurance company may deny their claims during a covered event.

The homeowner intentionally set the fire that caused the damage:

If an insurance agency suspects that a homeowner intentionally set the fire that damaged their home, then this may cause them to deny the homeowner's claim.

The homeowner's property was damaged due to a criminal act (arson or vandalism).

In this case, the cause of the fire is usually straightforward, and there's little room for interpretation on the part of the insurance agent. However, just because a criminal act caused property damage doesn't mean your policy didn't cover it. Check with your insurance carrier and their specific insurance department to see what is and isn't covered.

Why Your Insurance Claim is Denied - Some Common Reasons For A Denied Claim

1. Fraud

2. Negligence and carelessness

3. Outside of the policy coverage

4. Damage due to wear and tear

5. Intentional damage

6. Contaminated property

7. Undisclosed property

8. Catastrophic event

Does Home Insurance Go Up If Claim Is Denied?

Yes, you might see an increase in your homeowner's insurance rates, to which you can file a complaint with a formal letter. However, this might not reduce your rate from your insurer.

If you were denied because of a natural disaster or something out of your control, filing another claim later on shouldn't have any impact. You can always rate shop, in this case, with other top carriers or an independent insurance agent for their professional opinion on what insurance is best suited for your home.

Why Can An Fire Insurance Claim Be Denied?

1. Did you wait too long to file your claim? You must file fire insurance claims as soon as possible after the fire, or you might lose your right to compensation.

2. Did you fail to provide proof of your loss? Document your damages with photos and receipts showing what was lost in the fire.

3. Did the fire happen off-premises? If the fire started at a location other than your home. And then spread, the damage may be excluded from coverage.

4. Was the fire caused by an intentional act? If you or someone else did something that caused the fire, such property damage and repair costs are not covered.

5. Was the fire due to a poor maintenance issue? If it's determined that a failure to maintain a part of your home correctly caused the fire, it can deny coverage.

6. Was the fire related to illegal acts or activities?

Which Is A Common Reason Why Insurance Claims Are Rejected?

Most commonly, insurance companies deny claims for one or more of the following reasons:

1. The policy does not cover the damage that occurred.

2. The policy is expired or canceled before the damage occurs.

3. The amount of damage falls below your deductible.

4. The damage was intentional instead of accidental.

5. You failed to meet the requirements of your policy, such as properly maintaining your home (for property insurance) or seeking medical attention promptly (for health insurance).

6. There is evidence that you have filed fraudulent claims in the past, primarily if they were related to this same incident or type of loss.

Three Main Reasons Why An Insurance Company Denied Your Claim for Homeowners Insurance

Failure to pay premiums:

If you did not keep up with your payments, the insurance company might refuse to pay for any damage incurred on your property.

Failure to disclose pertinent information:

If you withheld any information about your property or yourself when you applied for insurance, the insurance company might refuse to pay for damages.

Unintentional misrepresentation of facts:

It can happen if you accidentally misspell the name of your street or forget the exact square footage of your home; the insurance company can deny a claim if it finds that you made a mistake in your application.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

Can An Insurance Company Decline A Claim at Will?

Yes. An insurance company has the right to deny your claim, but there are laws about the denying claims process and stipulations in your homeowner's insurance policy that will protect you. Your insurance company must follow these laws from your state's insurance department to avoid potential litigation. For example, if your claim was denied due to a mistake on the part of your insurance agent, you might have grounds for a lawsuit against them.

How Do You List Items On An Home Insurance Claim?

You need to list every item in your home that was destroyed or damaged in the fire. Even if something seems trivial — an old backpack or a pair of cheap gloves — it needs to be listed. Why? Because your insurance company will likely claim that if it's not on your list, it wasn't lost or destroyed in the fire.

Additional Resources

- The Insurance Process After A House Fire

- Dealing With A Difficult Insurance Adjuster's After a House Fire

- House Fire Insurance Payout

- How Much Is Fire Insurance A Month

- House Fire Insurance Got Denied

- What You Can and Can't Do With The Extra Money From The Insurance Claim

- What Happens If You Have a House Fire But I Have No Insurance

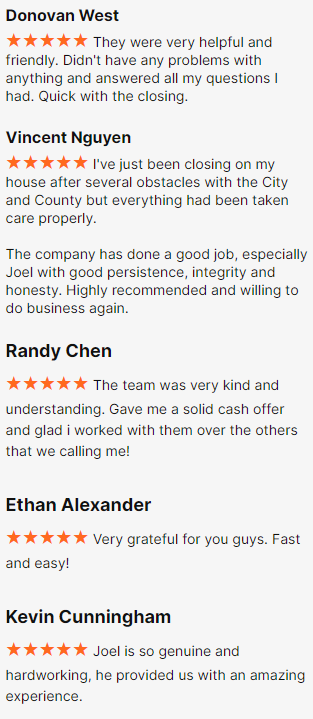

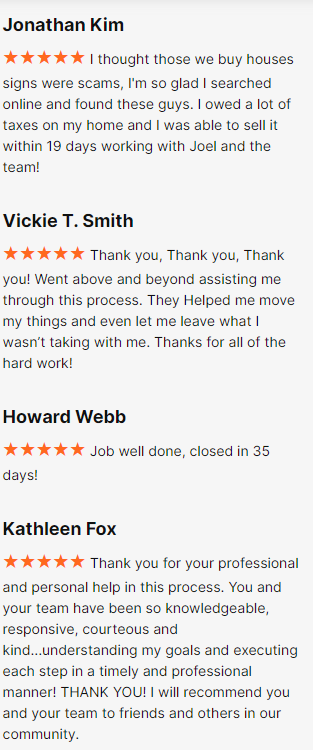

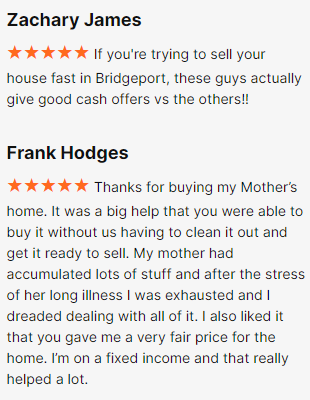

Happy Customers