How Does Insurance Work After A House Fire: Insurance Claim Process

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

After a house fire, it's hard to know what to do next. You may wonder how your homeowner's insurance policy works after a house fire, how to file an insurance claim, and what your next steps should be.

When it comes to home insurance claims, there are generally two types: first-party and third-party. First-party claims are filed by the policyholder and concern damage to their personal property. Third-party claims are filed by someone who was not involved in the policy but suffered injuries due to the event.

Going through the insurance process is not the only way to get out of a horrible event such as a home fire; there are other options. Many homeowners wonder can you sell a house that has fire damage, and the answer is yes, whether you plan to proceed with an insurance claim or not.

Throughout this article, we will discuss everything you need to know as a homeowner about fire insurance, how it works, how you can make a fire damage claim, work with a restoration company, and everything else you can do after a fire occurs at your home.

Is Fire Insurance A Thing?

es, fire insurance exists, and it protects the homeowner from financial ruin after a house fire. However, fire insurance claims are more complex than other types of homeowner claims made against a property.

A house fire can cause severe damage to the home's structure and destroy personal belongings, furniture, and valuables. However, with the right coverage, homeowners can get reimbursed for their losses after a fire by filing a claim with their home insurance provider if they have the proper insurance coverage or dwelling coverage.

What Risk Does A Fire Insurance Policy Normally Cover?

The most common fire insurance policy is known as an all-risk policy. Unless something is expressly excluded, it is covered by the policy. For example, most insurance companies' policies include coverage for:

Accidental damage by external means:

If damaged by external forces such as hail or windstorms, your home, and its contents are covered.

Explosion/implosion:

If a gas line or propane tank explodes, it should cover your home and its contents under your policy.

Aircraft damage:

Damage to your home caused by an aircraft (or other vehicles) crashing into your property is usually covered.

Riot, strike, malicious act, and terrorism:

The property is insured against damage caused by riots, strikes, or civil commotion for which police aid has been called. It also covers loss or damage due to acts of terrorism.

Impact damage:

The property is covered in the event of any direct loss or damage caused by the collision of any vehicle or animal with the property.

Storm, cyclone, typhoon, tempest, and flood:

All risks covered include loss or damage to the building, machinery, and electrical and electronic equipment by storms, cyclones, typhoons, and other disasters, including floods.

Subsidence and landslide, including rockslide:

The property is covered against loss or damage caused by subsidence and landslip, including damage from a rockslide.

Is Fire Insurance The Same As Home Insurance?

A homeowners insurance policy covers the structure of your home, general property damage, and your damaged personal items inside the home if you opt for additional insurance for personal property damage. In addition, the homeowner's insurance policy usually includes liability protection and coverage for incidents that occur on the property, such as someone falling or getting injured.

Fire damage and fire loss are usually included in homeowners insurance policies if the cause is accidental or negligence, although there are exceptions based on the policy specifics. For example, if the fire were caused by negligence, such as leaving something on top of a hot burner or not keeping your chimney clean, it would cover the damage. However, it may not be covered if it was due to an act of nature or an intentional act.

For more information on what might be covered in your specific insurance policy, it's best to speak with your insurance agent, who would handle claims and have a clear picture of what you can expect when dealing with a total or partial loss.

What Is The Process After A House Fire?

A fire in your home can be devastating and filing an insurance claim, and rebuilding can be stressful and confusing. Therefore, knowing what to expect from your insurance company is essential.

Your first step after a fire is to file a claim with your insurance company. Be sure to contact your agent or company as soon as possible — even if you're unsure if you have enough coverage to rebuild your home to its pre loss condition. Your insurer will help you figure out what's covered under your policy in regard to your damaged property and help you take reasonable steps to avoid additional costs.

What Are The Steps Of A Home Insurance Claim?

Filing a home insurance claim for a fire is broken down into six steps found below:

Call your insurance agent:

When something happens to your home, it's good to contact your agent immediately. They will provide guidance and help you understand how homeowners insurance work after house fires or other disaster strikes. In most cases, they will refer you to their 24/7 claims line or have your file online.

Determine if it's worth filing a claim:

Filing an initial claim starts the process of getting your home back in pre loss condition. The sooner you can get in touch with the claims team, the faster they will be able to assess the damage and help you figure out where to stay. It also reduces the risk of further water or smoke damage to your property, which will help mitigate damages.

Get your claim started:

First, your agent will ask for basic information about the incident, including any preliminary estimates of damage costs. Next, this information gets filed with the insurance company, and they assign a public adjuster to investigate what happened and determine what kind of damage occurred.

Write a list of everything that burned:

Writing a comprehensive list of all of your personal belongings that burned in the fire will help speed up getting reimbursed by your home insurance carrier.

Have receipts for any items that were destroyed or damaged by the fire if possible where your insurance policy requires it. Even if you don't have receipts, write down the value of each item/ the approximate amount of money your paid for each item that was lost in the fire. If there are items lost in the fire in boxes or containers, which you haven't gone through yet, don't touch them until after an adjuster has come to look at the damage.

Don't throw anything away until you talk to your insurance company first:

Your insurance company will want to inspect your property before they make any decisions about your claim, so before you start ripping things out or tearing down walls, call them and ask for instructions on what to do next. They might be able to tell you over the phone how to proceed and how long the fire insurance claim process will take.

The best thing you can do until you hear from the claims processing team is to secure your property to prevent vandalism and further damage like water damage from the elements and make sure your basic necessities are met.

Take pictures and videos of the damage:

Before you do anything else, it's essential to document the damage immediately after a fire. Take pictures and videos of all the damage, so you have proof of what happened when filing your insurance claim.

A fire damaged home can often have hidden damage that your insurance company adjuster might be able to see in a video or images your take of the home immediately after a fire. However, you should not delay notifying your agent if you don't have these videos and images.

Assess the damage after the insurance adjuster assesses the home

Assess the damage after the insurance own adjuster assesses the home in case you need to make temporary repairs.

Don't sign anything from the insurance company until you understand what you are signing and what impact that signing will have on your rights as a policyholder under your insurance contract and under your applicable state's department law surrounding fire damage.

When in doubt, always seek a second or third opinion during the claims process from other insurance company's, public adjusters, or contractors.

How Do I Prepare For A Fire Insurance Claim?

You'll want to collect as much documentation as possible. It includes photographs, receipts, police reports, and other items that can help substantiate your claim.

It's also important to keep track of all costs associated with the loss. That includes additional living expenses for temporary housing, food, restaurant meals, medical bills if you were injured, and other charges that you will have to pay as a result of the displacement.

What is the difference between actual cash value (ACV) and replacement cost value (RCV)?

Actual Cash Value includes depreciation of items destroyed in a fire or damaged by smoke or water. Replacement Cost is what it would cost to replace each item today without considering depreciation. If you have Replacement Cost coverage on your homeowner's policy, you will generally receive a more significant amount than if you had chosen Actual Cash Value coverage.

Consider Selling As-Is After The Insurance Claim Is Settled

Dealing with a fire-damaged house can be overwhelming, but after going through the insurance claim process and settling the claim, you might wonder about the next step. Discover the best approach to selling a fire-damaged house by considering the option of selling it as-is. Once the insurance claim is settled, you have the opportunity to take control of your situation and streamline the selling process. By connecting with specialized buyers experienced in handling fire-damaged properties, you can find a hassle-free solution that allows you to sell the house in its current condition. Selling as-is after the insurance claim is settled can provide a quicker path to moving on and starting afresh without the burden of extensive repairs. Embrace this option to secure a fair deal and unlock the value in your fire damaged house, paving the way for a brighter future.

How Do I Handle A Fire Insurance Claim?

1. Contact your agent or the insurance company as soon as possible after the fire.

2. Do not throw anything away until the insurance company has inspected it. There may be things that can be salvaged, even if they appear to be a total loss.

3. You may need to get estimates for repairs and replacement of damaged items, so start collecting the names of repairers and other contractors as soon as possible.

4. If you are renting, contact your landlord immediately and inform them of the damage to your property. They will probably want to file an insurance claim with their insurer.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

How Do I Handle A Fire Insurance Claim?

- The Cost Of A Fire Insurance Policy

- How to Calculate Fire Insurance

- The Insurance Process After A House Fire

- Dealing With A Difficult Insurance Adjuster's After a House Fire

- The House Fire Insurance Payout

- House Fire Insurance Got Denied

- What You Can and Can't Do With The Extra Money From The Insurance Claim

- What Happens If You Have a House Fire But I Have No Insurance

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

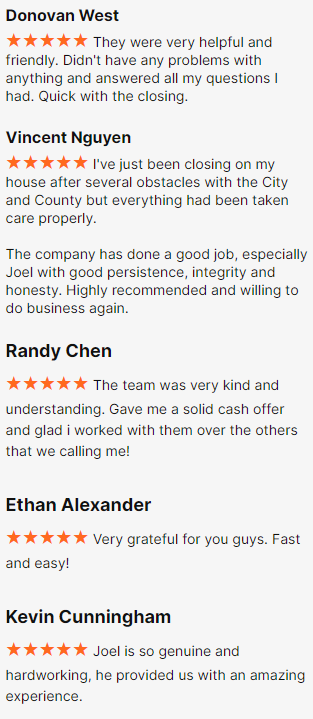

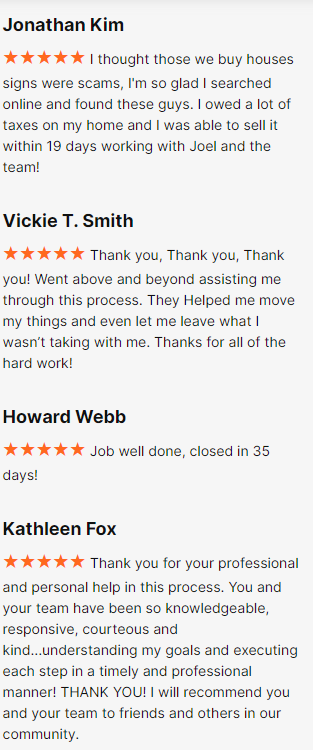

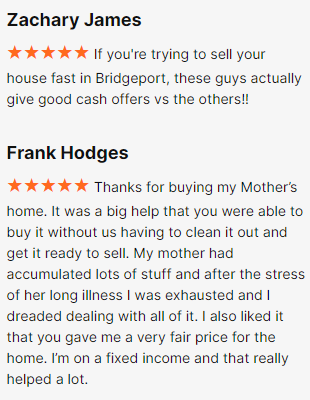

Happy Customers

All Rights Reserved | Fire Cash Buyers