House Fire Insurance Payout: All You Need To Know

A house fire can cause extensive damage and leave homeowners scrambling to pick up the pieces and other expenses that occur after a fire. One of the most critical tasks is filing a homeowner's insurance claim in the immediate aftermath. However, doing so can be confusing, especially if you've never filed an insurance claim before.

Throughout this article, we will discuss some of the most commonly asked questions about homeowner's insurance payouts, how to deal with a claim payout, working with an insurance professional, and working on temporary repairs or purchase replacements for damaged portions of your property.

A good thing to know is even after you receive your payout, you have two choices, either rebuild the property, which comes with its own stressors and headaches dealing with contractors and the city, so everything is backed up to code, OR you can sell your fire burned property as is and move on to the next chapter of your life.

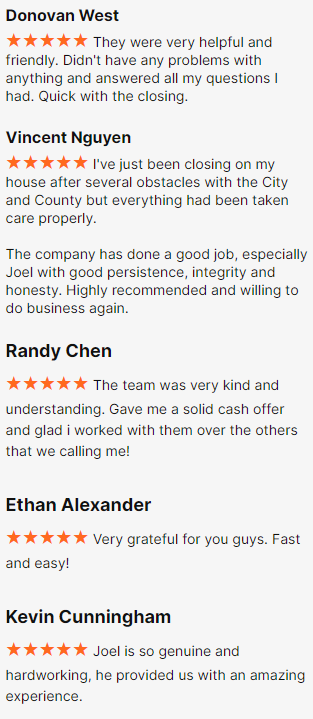

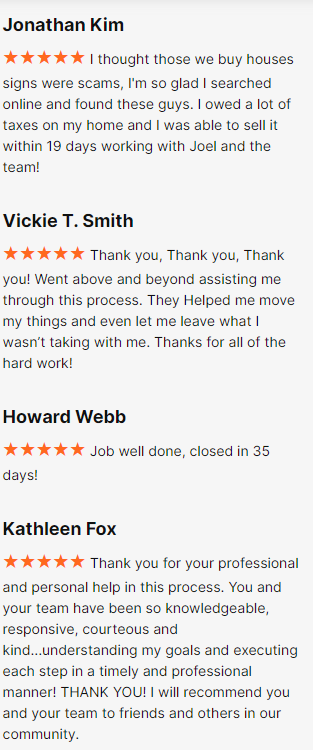

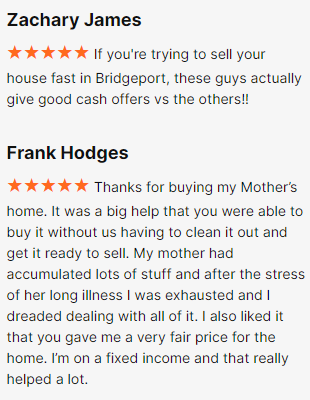

We've helped so many homeowners that say "need to sell my fire damaged house", you can read our reviews or simply fill out a no-obligation form.

How Does Insurance Work After A Fire?

If you have fire insurance, it's in your best financial interest to report the incident. Here's how it will handle your fire damage claim:

- You'll need to contact your insurance carrier and inform them of the loss.

- Then, they'll send out an insurance adjuster to inspect your home and begin the claims process.

- Your insurance company will then determine the extent of the damage and what it will cost to repair or replace what was lost based on contractor's bid estimates.

- Finally, you'll receive a check for that amount. Which you can use the insurance money to replace any lost documents in the fire.

What Do Insurance Companies Do When Your House Burns Down?

Fortunately, a house fire insurance payout will cover damage caused by the fire. However, the total amount of compensation you receive will depend on your policy limits, the extent of the damage, and if there are additional coverages like the replacement value policy or building ordinance coverage.

Insurance companies generally do not take your house when it burns down unless you have outstanding payments that you have failed to make or if you have committed insurance fraud.

If your house burned down and you didn't have an insurance policy on your property, this could land you in a difficult situation with your mortgage company. You either have to pull the cash out of pocket to repair both the structure and your personal belongings or try to sell your home as is.

How Does Home Insurance Work With A Fire?

Home insurance policies cover damage or destruction to a home and its contents. The amount of coverage depends on the type of policy you have.

A standard homeowners policy (HO-3) typically covers fire damage to the home and personal property, with less applicable deductibles. It also includes additional living expenses (ALE) if you are forced to move out while your home is being repaired or rebuilt.

Do You Get Insurance Money If Your House Burns Down?

Yes. The good news is that most insurance companies cover fire loss with the insurance proceeds from a claim. However, it's important to note that while your insurance agent will pay for repairs or rebuilding costs, you may not receive the exact replacement cost of your home and personal belongings during the claims payout. That's why it's so important to make sure your home is adequately insured in a fire.

How Do I Get The Most Out Of My Fire Insurance Claim?

Here are some tips to get the most out of a fire Insurance claim:

- Do not rush into making a house fire claim. Instead, take your time to ensure all your home insurance claims are valid and reasonable. If possible, conduct a proper assessment of the damage before speaking to your insurance company. You can then send the report to your insurer.

- Find out if you can obtain compensation from other sources such as employers, manufacturers, and others who may be liable for some of the damage or loss.

- Always keep the receipts when you buy replacement items such as household appliances and furniture.

What Does Insurance Pay For After A Fire?

If you have a house fire, you will want to know what your homeowner's insurance policy covers and what it doesn't; this might vary depending on state law. It is because the payout from your homeowner's insurance policy will determine how quickly you can rebuild your life after a fire.

Policies vary from one provider to the next. However, when shopping for homeowners insurance, you should make sure that the coverage that you get is adequate for your needs and, more importantly, so that it can pay out enough money to ensure that you can rebuild if the need should arise.

What Is The Average Clause In Fire Insurance Claim?

The average clause in fire insurance claims refers to the payment made under an insurance company to compensate for any loss or damage that has occurred due to the insured event occurring.

If the value of the item damaged or destroyed by the insured event is more than what is insured, you will only receive a proportionate payment based on how much was insured under the policy.

For example, imagine you have a house valued at $500,000, and it is fully covered under your fire insurance policy for $100,000. Therefore, if a fire caused $120,000 worth of damage to your home, you would generally receive $100,000 from your insurer because that is what is covered under your policy.

How Long Does It Take To Get Insurance Money After A Fire?

In most cases, it will take your insurance company 90 days or less to process your claim and provide a payout. However, several factors can affect the timeline, including the extent of the damage, whether you have replacement cost coverage or actual cash value policy coverage, and how quickly you submit the necessary paperwork.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

How Long Does It Take For Insurance Companies To Reimburse?

Many insurance companies will issue an advance payment within a few days of filing the claim, especially if the damage is extensive. However, advance payment is a partial payout for the repairs and may not account for all of your losses throughout the entire claim.

It isn't easy to estimate how long it will take to settle a home insurance claim because every situation is different. However, you should expect the process to take one to six months. Until then, your insurance company will probably pay your living expenses if you cannot live in your house while repairs are being made.

How Long Does It Take To Get Insurance Payout?

The time it takes to get a settlement from the insurer depends on several factors: the type of loss, how much damage occurred, and whether you have replacement cost coverage or actual cash value coverage, among other things.

If you submit a claim for stolen property, your insurer will probably want you to provide receipts or proof of ownership before processing your claim. If your roof needs to be repaired due to weather damage, a public adjuster may need to inspect it before evaluating the damage and preparing a quote for repair costs. The amount of time it takes for an insurance payout can vary widely by case.

Can You Negotiate Total Loss Payout?

No, you can't. The payouts are based on the fair market value of the items your insurer determines are lost or damaged no the cash value payment you made on the items. If you disagree with the payout, you can hire an independent appraiser to assess your property's worth and try to convince your insurance company that it's worth more. But if your insurer won't budge and you want to continue using that insurer, you may have to accept a lower amount.

When The Insurance Company Provides A Payout, Is The Money Removed From?

In most cases, the insurance company will pay the mortgage lender directly and send you a check for your portion of the loss. You may receive these checks depending on whether you have replacement cost coverage or actual cash value coverage.

Repairing your home after a fire can take time. And it can be pricey—especially if you have to live somewhere else while repairs are being done. While the last thing you want to think about after a house fire is money, you must know what to expect regarding insurance payments. Here's what you should know.

How Do Insurance Companies Determine Actual Cash Value Of Home?

Insurance companies determine your property's actual cash value (ACV) based on what it would cost to replace your property minus the depreciation amount. ACV is used to determine reimbursement amounts for partial losses when a home is insured for less than its total replacement cost or when a policyholder chooses not to rebuild completely after a loss.

Addition Information You Should Know

- How Does Insurance Work After A House Fire

- How To Deal With A Difficult Insurance Adjuster After a House Fire

- All You Need to Know About Your House Fire Insurance Payout

- Can You Keep The Extra Money From The Insurance Claim

- What Can You Do If Your Fire Insurance Claim Gets Denied

- House Fire But I Have No Insurance

- How Much Is Fire Insurance For A House